do you have to pay taxes on inheritance in michigan

The first rule is. Whether youll pay inheritance tax and how much youll pay depends on a variety of factors including which state the deceased lived in and what your relationship to the deceased was.

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

The top estate tax rate is 16 percent exemption threshold.

. Although Michigan does not impose a separate inheritance or estate tax on heirs you may have to pay state taxes on your annuity income. The federal government does not have an inheritance tax. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect.

I will be splitting it with my sisters. Below well go through several key rules to help you determine when you might have to pay taxes on an inheritance. Its estate tax technically remains on the books but since 2005 there has been no mechanism for it to collect it.

In Pennsylvania for example the inheritance tax can apply to heirs who live out of state if the descendant lives in the state. We will be opting for the lump sum payment I believe the total was 30000. Michigan does not have an inheritance tax.

However while you may not have to pay capital gains or income taxes on the inheritance from a trust there are still other taxes and fees you may have to pay especially if you inherit. Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019. Unlike the federal estate tax the beneficiary of the property is responsible for paying the tax not the estate.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. Michigans income tax rate is a flat 425 and. Michigan does not have an inheritance tax with one notable exception.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Of course state laws are subject to change so if you are receiving an inheritance check with your states tax bureau. Where do you pay inheritance tax in the US.

Its only applied to an estates beneficiaries if the decedent passed away on or before Sept. Only a handful of states still impose inheritance taxes. The Michigan inheritance tax was eliminated in 1993.

According to the michigan department of treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of michigan. Died on or before September 30 1993. Contact the Tax and Customs Administration for more information.

If you stand to inherit money in Michigan you should still make sure to check the laws in the state where the person you are inheriting from lives. An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. Its only applied to an estates beneficiaries if the decedent passed away on or before Sept.

Its applied to an estate if the deceased passed on or before Sept. A benefactor pays inheritance tax after receiving his or her portion of the assets. Exemptions From Inheritance Tax.

1 How much can you inherit without paying taxes. Ad Inheritance and Estate Planning Guidance With Simple Pricing. No estate tax or inheritance tax.

According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of Michigan. You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you inherit might come with some built-in income tax consequences. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate.

Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who. What is an Inheritance Tax. Mom recently passed and left an IRA with me listed as beneficiary.

Michigan does not have an inheritance tax with one notable exception. In certain special situations you pay less or no inheritance tax. Only six states Iowa Kentucky Maryland Nebraska New Jersey and.

However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier. For 2019 the lifetime transfer exemption for individuals was 114 million based on the value of the estate at the time of death. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

However as of 2021 only six states impose an inheritance tax. However federal estate tax laws do apply to michigan estates. A beneficiary or heir could conceivably be taxed if an asset is discovered years later but the decedent died on or before this date.

How much inheritance is tax free in Michigan. No estate tax or inheritance tax. What is Michigan tax on an inherited IRA.

Do you pay taxes on inheritance in michigan. Michigan no longer has an estate or inheritance tax. For example if you inherit a traditional IRA or a 401k youll have to include all distributions you take out of the account in.

The Michigan inheritance tax was eliminated in 1993. Inheritances that fall below these exemption amounts arent subject to the tax. How much or if youll pay depends upon where the annuity came from and how much its worth.

It does have an inheritance tax but only for bequests made by decedents who died on or before September 30 1993. Michigan does not have an inheritance tax. The surviving dependants pension however is deducted from the partners exemption.

This increases to 3 million in 2020 Mississippi. There is no federal inheritance tax. Mom had opted to have federal taxes withheld at 10 but not have Michigan state tax withheld.

So youd have to be part of a fairly large trust one with at least 1 million in assets to receive an interest-funded disbursement that would affect your income and tax liability. The eight states that levy an inheritance tax comprise Indiana Iowa Kentucky Maryland Nebraska New Jersey Pennsylvania and Tennessee. You do not pay inheritance tax on a surviving dependants pension or state pension.

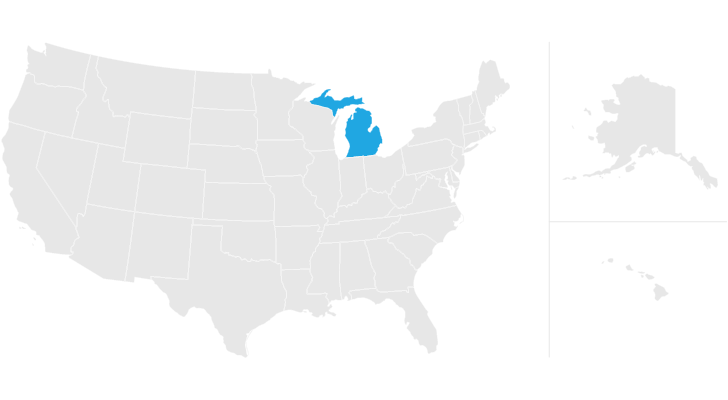

Michigan does not have an estate tax. Like the majority of states Michigan does not have an inheritance tax.

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Estate Tax Everything You Need To Know Smartasset

Frugal Retirees Ditch 4 Percent Rule Hoard Savings Instead Frugal Hoarding Retirement

I Just Inherited Money Do I Have To Pay Taxes On It

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

Rockstar Games Made 4b Between 2013 19 Paid No Corporate Tax In The Uk Claimed 42m In Tax Relief Boing Boing Http Ow Rockstar Games Games Tax Credits

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Why Does An Organization Or Person Need A Tax Consultant Aterian Income Tax Inheritance Tax Accounting Services

Free Tax Preparation From Aarp Foundation Tax Aide Tax Preparation Aarp Tax Services

Do I Pay Taxes On Inheritance Of Savings Account

Michigan Estate Tax Everything You Need To Know Smartasset

Do You Know How Much Your Gym S Tire Weighs Here Is A Convenient Easy To Use Tire Weight Chart To Determine How Much Weig Florida City Safe Cities Florida